Nov 1, 2016 | BBC World Service, China - what we can learn, Clean Tech, Electric Vehicles

By Alison van Diggelen, host of Fresh Dialogues

The race to build the “ultimate” electric car is heating up. Every month, it seems another electric car company joins the fray to offer a car stylish enough to attract the Tesla crowd, and affordable enough to meet the growing demand from China, the United States and Europe.

NextEV stands out from the crowd for two reasons:

- It has solid backing, from a broad range of top venture capital and Internet companies like Sequoia and Tencent.

2. Its Silicon Valley R&D facility is led by Padmasree Warrior, “The Queen of the Electric Car” and she’s rapidly attracting top tech talent from the likes of Tesla and Apple.

Last month, I attended the grand opening of NextEV Silicon Valley and interviewed its founder, William Li. He shared his “Blue Sky” ambition (he means it literally) and how his grandfather inspired him to go from cattle herder to Internet multi-millionaire. It was the first interview he’d ever done in English. I filed this report for the BBC World Service’s Tech Program, Click.

Here’s a transcript from today’s program, with some great insights from host Gareth Mitchell and BBC contributor, Bill Thompson. The transcript has been edited for length and clarity:

BBC Host, Gareth Mitchell: One event that did happen was the recent launch of yet another electric vehicle outfit in California. This is the Silicon Valley division of a Chinese startup called NextEV. The champagne flowed and the ribbon was cut – the digital ribbon – but our reporter Alison van Diggelen was most interested in the economics of it all. You don’t need to be an investor to know just how risky these ventures are as the technology gradually matures. In California and China state funding and tax breaks are all part of getting these businesses off the ground. Alison tracked down NextEV founder, former cattle herder and now big time entrepreneur, William Li.

Alison van Diggelen: At NextEV’s Silicon Valley launch, William Li confirmed that on November 21st, NextEV will reveal its first supercar in London. The electric car is expected to offer a 0-60 acceleration in under three seconds. Its Formula E racing team has used a dual-motor setup on its race car, and it’s likely to be a feature of the supercar. (The top speed of the sleek two-seater will be over 180 mph, and its price is likely to be equally extravagant!)

NextEV is late join to the electric car race. So how does Li intend to challenge Tesla and the dozens of electric car companies popping up worldwide?

William Li: Tesla is a great company, I respect them. But Tesla was founded 2003. Lots changed. It’s a mobile internet era. We can do better to communicate with our users, give our users a much better holistic user experience.

He aims to do for the car what Apple did for the smart phone.

He learned a lot about user experience from Bit Auto, a popular web portal in China and his first business success. He’s now built a global startup – with facilities in Beijing, Shanghai, Silicon Valley, London and Munich. The global workforce is 2000.

He learned a lot about user experience from Bit Auto, a popular web portal in China and his first business success. He’s now built a global startup – with facilities in Beijing, Shanghai, Silicon Valley, London and Munich. The global workforce is 2000.

In Silicon Valley, its 250-strong team of auto and software experts is growing rapidly. U.S. CEO Padmasree Warrior – former CTO at Cisco – is hiring experts in artificial intelligence, voice interaction and user interface from the likes of Tesla, Apple and Dropbox. Warrior says they’re already working on affordable cars for China’s burgeoning demand.

Padmasree Warrior: In China, There’s a large shift happening … Environment issues are driving the government to look at electric vehicles as part of the solution… It’s healthier for the environment to drive an electric vehicle.

China is offering generous tax incentives to electric carmakers and consumers, driving a flood of companies into the space. NextEV recently signed an agreement with the Nanjing Municipal Government in China, to build a $500 million factory to build electric motors.

Similarly in Silicon Valley, a fleet of electric car companies has chosen to locate here, thanks to state tax incentives and the strong talent base. These include Tesla, Atieva, and Le Eco.

I spoke with California’s Director of Economic Development, Panorea Avdis. She explained how state policy is helping reduce greenhouse gas emissions, by focusing on the tech industry…

Panorea Avdis: The goal is to have 1 million electric zero emission vehicles on the road by 2020.

(Today, California has about 300,000 electric cars, about half of the nation’s total.)

Alison: NextEV secured $10M in tax credits. Tell me why that’s cost effective for the people of California.

Panorea Avdis: The return on investment…nearly 1000 jobs in the next 5 years, speaks for itself. California is leading the way, there’s no other state in the union that has this type of aggressive polices and it’s really inspiring this innovation in technology to come forward.

But making cars is notoriously hard. News broke this month that Apple is shelving its electric car plans to focus on self-driving software.

William Li knows it’s a tough road ahead. He gives his company just over a 50% chance of success.

As a boy, Li was a cattle herder in China. He’s come a long way and credits his grandfather’s wisdom:

William Li: [Speaks first in Mandarin ] The journey is more important than the result. So follow your heart….your original wish. Don’t worry about failure.

Like Tesla’s Elon Musk, Li is concerned about climate change and also the dense smog in Beijing and Shanghai. He blames polluting gas-guzzling cars.

NextEV’s brand in China is called “Way-Lye”

William Li: It means blue sky coming. That’s my original wish.

It’s an ambitious goal that could be a very long way off, especially in China’s congested and polluted cities.

Gareth Mitchell: That’s Alison van Diggelen reporting from Silicon Valley. So Bill Thompson – the journey is more important that the result?

Bill Thompson: The result is much more important than the journey here, because unless we get much cleaner public and personal transport, then we’re in big trouble. It’s really good to see another serious entrant in this market. It’s not sewn up yet by anyone. As we heard there about Tesla, there’s no first mover advantage because the technology is developing so quickly.

We know Padmasree Warrior’s reputation for delivering. She’s been on the show a few years back. She was senior at Motorola, then went to Cisco. They’ve got really good people.

But the really interesting part of this is what happens in China. In China because they have much more control over what people can do. The government can actually mandate a move to electric vehicles much more easily than they ever could in California and that gives a great market. So NextEV may be getting money and expertise over in Silicon Valley, but it’s what happens in China that’s really interesting.

Gareth Mitchell: I was interested in the economics side of the piece: the reliance partly on state funding to get these businesses going.

Bill Thompson: Occasionally state funding helps. You might have heard of this little thing called the Internet, kicked off with defense department funding from the US. It did pretty well by being able to rely on that funding for a critical period while it developed and then was able to be used by the private sector. One or two of these examples of it actually working…

Mar 9, 2016 | China - what we can learn, Education, Entrepreneurship

By Alison van Diggelen, host of Fresh Dialogues

This week, artificial intelligence (AI) reached a significant milestone. For the first time, Google’s DeepMind unit beat the legendary champion of Go, a highly complex board game. Machines are now being built with self-learning mechanisms that simulate the neural network of the human brain. What does this mean for the future of AI and its ability to replace humans in the workplace? The future just got closer.

Sebastian Thrun is well known for being a pioneer in artificial intelligence and autonomous cars, but is now laser focused on making sure online education bridges the skills gap, via his company, Udacity. Here’s what he said recently about AI:

“Udacity is my response to the development of AI. The mission I have to educate everybody is really an attempt to delay what AI will eventually do to us, because I honestly believe people should have a chance.” Sebastian Thrun*

I sat down with Thrun at the company’s headquarters in Silicon Valley to explore his grand vision and audacious promises. Last year, Udacity raised $105 million in venture funding, based on a valuation of $1 billion. Is this another overpriced Silicon Valley unicorn or is the value justified?

First, a little back story: In 2012, Thrun was astounded at the massive number of people signing up for his Stanford AI course online course: 160,000 in all, mostly from outside the United States. He quickly realized that online education has the potential to make learning affordable and reach millions globally.

“Nothing has more potential to unlock a billion more brains to solve the world’s biggest problems,” wrote Tom Friedman in 2013. But of course, his and Thrun’s rosy predictions couldn’t happen overnight. The online learning business had some serious teething problems with high drop out rates, and dismal failure rates. But today, the future of online education is looking brighter.

There are now countless online education companies globally. The big three are: Coursera (a Stanford startup) which now boasts 15 million students; EdX (affiliated with MIT and Harvard) with over 5 million users; and Udacity, 4 million.

Since Udacity’s high profile failure at San Jose State, the company has refocused its online courses and recently partnered with Google, AT&T and Amazon to design “nanodegrees” tailored to the needs of tech companies. Thrun is so bullish about the market value of these 4-12 month nanodegrees, which offer project based learning, that he’s offering a money-back job guarantee.

“For certain Nanodegree programs we’re offering all your tuition back unless we or you find yourself a job within the first 6 months of graduation. For the student, the education is basically free. … These are jobs that pay $80,000 or more, maybe $120,000 in Silicon Valley. With the first month’s salary they can recoup all tuition or we just pay them tuition back…“ Sebastian Thrun, CEO Udacity

Here are more highlights from my conversation with Sebastian Thrun:

Here are more highlights from my conversation with Sebastian Thrun:

On Redefining Education

I think education has to shrink: We have to stop thinking of education as a four or six year investment you can only afford once in your life. We have think of education as a lifelong thing, to shrink the size of our degrees and make education a daily habit, the same way we brush our teeth every day. We have to redefine what education really means.

On Access to Education

Elite colleges like Stanford are extremely inaccessible. They’re failing in their mission to provide access. The Udacity recipe is exactly the opposite – we want to reach everyone and have no admission hurdle. We want to be able to educate people. We do this today in Ghana, in Sub Saharan Africa, in Bangladesh, in China, around the world. If we do this, we can have a substantial impact on the world’s GDP because so much talent is under utilized because of lack of education. If we give people in Syria the same chances as kids in America have, it’s going to be spectacular.

On Persuading Skeptics

The question is still open how much a nanodegree will become gold standard…this takes time. But some companies earmark jobs specifically for us, give us preferential treatment. Google even invites the top nanodegree finishers on campus in Mountain View to meet their recruiters, which they don’t do with other universities….

And others are still skeptical. People are hired on conventional credentials and many of our students are career shifters. They don’t have the 20 years of history that a seasoned person has.

Meet Kelly Marchisio

Last year, Marchisio got a promoted from customer service to “web solutions” engineering at Google after completing Udacity’s nanodegree. She said of her 6-month intensive program: “It’s industry relevant, fun…maybe I’m just a nerd but I really enjoy spending my weekends working through programming materials.”

Marchisio adds, “I’d guess there are more women in a Udacity program than there would be in an academic course…an online environment feels more safe…less social pressure. You can try things on your own, make mistakes and not feel embarrassed about it.”

On Udacity’s China Expansion

China has 20 million college students. It’s huge. It has a thriving new middle class and can’t keep up with brick and mortar university buildup to meet the demands of these people.

I want to go there and tell them look: You can become a Silicon Valley trained Android iOS engineer, a data scientist, a cyber security engineer, even a self driving car engineer for almost no money in about half a year.

Note: Udacity currently has an office in China and plans to roll out its learning platform, by replicating Google tools and building its own server farm in the second quarter of 2016.

On his Moonshot, 50 Year Vision

Conventional degrees will be gone. We’ll abandon the idea of education first, and then work.

I see people starting work straight out of high school and bringing experiences, deficiencies, desires back into education. We’ll have a life where education and work is on all the time. The old fashioned – you get born, ed, work, retire and die is obsolete. We have to do all these things at the same time, with the exception of death of course!

We have to learn to play, to get educated. We have think of life as a process, not as an accomplishment, but have a growth mindset for our lives. That will be the case because 50 years from now, things will be moving so insanely fast that to stay current, a college education will expire faster than its course.

***

In conclusion, it looks like Udacity has found a sustainable business model by focusing on the IT job market. The company currently has about 11,000 students enrolled in its nanodegree programs, each paying approximately $200/month, producing an estimated annual revenue of over $26 million. If Thrun can continue to drive rapid growth, compete effectively against the growing competition and replicate the company’s current success as it expands in China, then perhaps that $1 billion valuation doesn’t look quite so make-believe.

*Interesting to note that although Thrun offers online education as a way to “delay” the massive job losses that AI will eventually produce, Udacity’s top listed nanodegree is…you guessed it: machine learning. Otherwise known as AI.

Jul 14, 2015 | BBC World Service, China - what we can learn, Inspiring Women

By Alison van Diggelen, host of Fresh Dialogues

Six years ago, she founded the first community supported agriculture (CSA) farm in China. Today, organic farming pioneer, Shi Yan and her team serve hundreds of city dwellers in Beijing; and her thriving Shared Harvest Farm has inspired dozens of CSAs across China.

Shi Yan is one of a growing group of farmers in China who are bucking the trend of young workers abandoning agriculture and being drawn to cities like Beijing, one of the world’s largest conurbations. By helping bring young people back to the land and serving the growing demand for sustainable practices and organic food in China, Shi Yan has attracted the attention of major media outlets, NPR and the BBC.

.

On July 10th, I was invited to join BBC host,

Fergus Nicoll on

BBC World Service program,

Business Matters to interview Shi Yan about her mission; and explore the economic and social drivers for organic produce in China.

.

Fergus Nicoll: We are going to devote much of the second half of the programme to environmental issues. We’ll hear about Community Supported Agriculture in China and our guest

Shi Yan is with us from Beijing…Let’s welcome Alison van Diggelen of Fresh Dialogues. Alison, we’re going to leave your microphone open.

Alison, as anybody who knows her website

Fresh Dialogues, is a professional asker of questions. Alison: jump in when you fancy and we’ll make this a three-way discussion.

Shi Yan, tell us a bit about Shared Harvest…and the concept of community supported agriculture.

Shi Yan: Our farm

Shared Harvest is located in

Tongzhou district of Beijing. Right now we have about 15 hectares of land we rented for 15 years. Most of our produce is vegetables and we also have almost 2000 chickens and 50 pigs. Every week we deliver our produce directly to our members. CSA is a way that links the farmers and the consumers directly and

we build the trust between the consumers and the farmers. Right now we have about 600 families in Beijing; most of their food comes from our farm.

Fergus Nicoll: Is that entirely organic or are you allowed to sneak in some pesticides or herbicides?

Shi Yan: Actually we call our produce “organically produced” because we don’t have the organic certification but we don’t use any chemical fertilizer and pesticides.

Fergus Nicoll: What about the market for that, because in different countries the market for organic food has waned and grown depending on economic circumstances…a growing middle class wants a purer production mechanism…even if it’s not organic with a capital “O.”

Shi Yan: In China in the last seven years, organic agriculture is growing pretty fast because of issues related to

food safety, environmental issues. When I started in 2009…very few consumers knew about the concept of CSA, but right now a lot of people in Beijing know this model.

.

.

..

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Fergus Nicoll: A lot of people who buy organic face criticism from people who don’t. They’ll say: I go to the supermarket and I see a box of six perfectly produced apples, they all look 100% identical like clones, selling for “X” and next to that are organic apples that are kind of lumpy, they’re all different shapes and they cost “X plus” Do you ever get that complaint?

Shi Yan: If you order the vegetables from a CSA farm (in China) the price is about 2/3rds of the price in the supermarket. Right now, consumers care more about the food quality rather than the price. A lot of them are rethinking our food system because if you only look at the appearance of the fruit or vegetables…a lot of food (in non-organic farms) is wasted because of their appearance.

Alison van Diggelen: I’m curious about the drivers in China. Do you have a feel for your consumers…Is the

impact of pesticides etc. on the environment is that a major driver? Or would you say the main drivers are food scares and the quality of produce?

Shi Yan: At the beginning the food safety issues…a lot of food scandals happened and people started looking for healthy food. But later they found the deep reason is not the market or the food itself, but a lot of problems happened in the rural (areas)…food comes from the village and in last 10 years, fewer and fewer young people stay in the village. Right now most of the farmers growing the food are above sixty years old, struggling for their livelihood. Can they really take the responsibility of producing healthy food? It’s a big problem.

Fergus Nicoll: Can I ask you about “labor shifting” consumers actually doing the farming themselves? Because they’re extremely motivated but may not know the best way to do it.

Shi Yan: We have two models: one part you can order our produce, we will deliver to your door. (Or) you can rent a piece of land: 30 square meters of land, as a farm. Every week you can come to your farm, grow your own food.

Alison van Diggelen: I’m curious about how you’re delivering your food. Are you using electric cars, non polluting cars, delivery trucks?

Shi Yan: We use conventional small vans.

Fergus Nicoll: In the US, if I go and see friends in Davis, I know when we go down to the farmers market, there’ll be really good stuff. This is relatively well established, certainly in California?

.

Alison van Diggelen: Absolutely, yes,

CSAs are very established here, since the 1980’s. Here’s an interesting anecdote for you, Fergus: I’ve been a subscriber to a local CSA called

Planet Organics and just this month they’ve had to close up shop after 19 years. They’ve been squeezed out by major players. Walmart is getting into the organic food business. Wholefoods has been there a while. It’s becoming so mainstream that it’s hard for these CSAs to compete.

Fergus Nicoll: So they’re getting priced out of the market…

.

To be continued.

Sep 26, 2014 | BBC World Service, China - what we can learn

By Alison van Diggelen, host of Fresh Dialogues

Jack Ma may be the richest man in China, but he’s also one of the greenest. Or is headed in that direction. He has commented publicly on China’s serious pollution and said that it’s a problem that “must be solved.” The Ma man is putting his money where his mouth is (see below for details).

Since 2009 he’s served as the Chairman of the Board on the Nature Conservancy’s China program and says, “Our challenge is to help more people to make healthy money, “sustainable money,” money that is not only good for themselves but also good for the society.”

So what’s behind Jack Ma’s environmental conscience? With vast wealth comes the ability to take a longer term view of the world:

“Most companies, when they’re doing good, they enjoy today’s wonderful life. They don’t worry about five years later—but I worry about five years later,” says Jack Ma. “I think one thing’s for sure — China’s environment will get better in 10 or 20 years. Business people like myself are beginning to pay attention to social issues including the environment and taking action and really treating this issue very seriously. And we’re doing it not for P.R. reasons, but because we know it is important. We know it is serious and that if we don’t take action, it will hurt ourselves, our children and our families.”

McDowall: Our guest is Business Matters regular, Alison van Diggelen. Among her many talents, Alison is an acclaimed interviewer and is host of the Fresh Dialogues series, which you can find online, and which features experts on green technology, sustainable enterprise, celebrities and inspirational women… Alison, good afternoon to you in the Golden State. Can we talk for a minute about Alibaba? What do you make of this chap Jack Ma?

van Diggelen: Well I’m quite impressed by Jack Ma.

Of course, I’m always looking for the environmental, green angle as you mentioned earlier Mike. And he’s probably made enough money for a small country to live on, so he’s really turning his attention to the environment. He’s actually a major player in putting the attention on China’s environment. Its really bad: air pollution, water pollution. So I understand he’s putting 0.3% of the revenues from Alibaba into environmental causes, which I say: three cheers to that! (Reuters reports Alibaba’s revenues were $2.4Bn in the last quarter).

McDowall: Point three percent? Mind you, the revenues are enormous.

van Diggelen: Yes, absolutely. That’s probably a good tranche of money there.

McDowall: So he’s obviously someone we’re going to be seeing a lot more of in the future. He appears to be keen to raise his profile internationally. He’s obviously very well known in China and you know, ringing the bell on Wall Street…Yahoo was a big investor. We’re going to be seeing a lot more of this guy.

van Diggelen: I think a lot of people…the froth and the excitement…part of the reason for that is that it’s an opportunity for global investors to buy into China’s growth and as everyone knows that is just poised to keep growing. I think only half of the Chinese population is online, so there’s a lot of growth potential there.

McDowall: Sure. We’ll keep watching….

Keep listening to our conversation as we discuss: The Scottish referendum, Larry Ellison’s retirement and why the Ig Nobel Prizes will make you laugh, then make you think.

You can listen to other Fresh Dialogues BBC Conversations here where we discuss: the future of driverless cars, Apple’s green credentials, Tesla’s new gigafactory and many more topics.

May 5, 2014 | China - what we can learn, Electric Vehicles, Storage, Technology, Venture Capital & Finance

By Alison van Diggelen, host of Fresh Dialogues

It’s no secret that cleantech has taken a bashing in the last few years, yet Andrew Chung, a partner at Khosla Ventures is still bullish about the sector’s prospects and convinced that it makes sense long-term, both domestically and globally. During our recent hour-long conversation, he admits that “keeping the cleantech fire burning” is the first thing he thinks about when he wakes in the morning.

“The number one thing is to ensure the cleantech industry continues to survive and thrive,” says Chung. He cites several companies in his portfolio that recently raised large rounds at strong valuations.

Keeping the fire burning? It’s curious imagery for someone focused on clean energy; and technologies that lower our carbon footprint. I imagine him cheerfully stoking a bonfire, plumes of black smoke filling the air.

“Would you like to qualify that?” I ask.

He chuckles, “Yes…we would capture the carbon created by the fire and transform it into something else.”

It’s a fitting segue into one of his favorite investments: LanzaTech, a company that happens to do just that. It takes carbon capture one step further, capturing waste gases like carbon monoxide from heavily polluting steel plants and converting them into “valuable fuel and chemicals.”

He calls it one of his Black Swans – highly improbable investments, that are not incremental improvements on business as usual, but giant technological leaps.

“This is cleantech done right,” Chung says. “The technology is so compelling.”

So compelling that the company recently announced a joint venture with Baosteel, a major steelmaker in China, which is investing in a new commercial facility due to come online in 2015. LanzaTech’s zero capital contribution to the deal means it can continue to scale up and pursue other partnerships in Japan, Europe, India and Russia.

I was curious to learn who helped with the initial discussions to broker the deal? None other than former British Prime Minister, Tony Blair. Those paying close attention to Khosla Ventures will remember he joined the team as a strategic advisor in 2010.

So what makes it such a compelling deal? Chung calls it a confluence of events. The blanket of smoke over Shanghai being a palpable one, leading to pressure from the Chinese government on major polluters like steel makers to clean up their act. There’s also the global ambition of many Chinese businesses who view such partnerships as strategic moves.

Societal tensions add to the pressure to solve China’s huge environmental problem. Even Jack Ma, China’s Andrew Carnegie is focusing his new philanthropic trust on health and the environment.

CONSPICUOUS ABSENCE

You’ll notice that the United States is conspicuously absent from LanzaTech’s partnership list. That fact is also at the top of Chung’s mind. Several of the potentially transformative technology companies he backs are finding it easier to get global partners than American ones.

“How do we communicate this message to D.C.?” says Chung. “If technology is not supported here, it will leave our shores.”

Chung feels the regulatory environment means that American companies are more complacent and have less appetite to take risks. He cites the U.S. car industry where employees get bonuses whether or not they achieve product improvements.

“It needs a regulatory push to compel them to take greater risk,” says Chung. “We don’t have the dire need like in China where (almost) 1 million people are dying of pollution every year.”

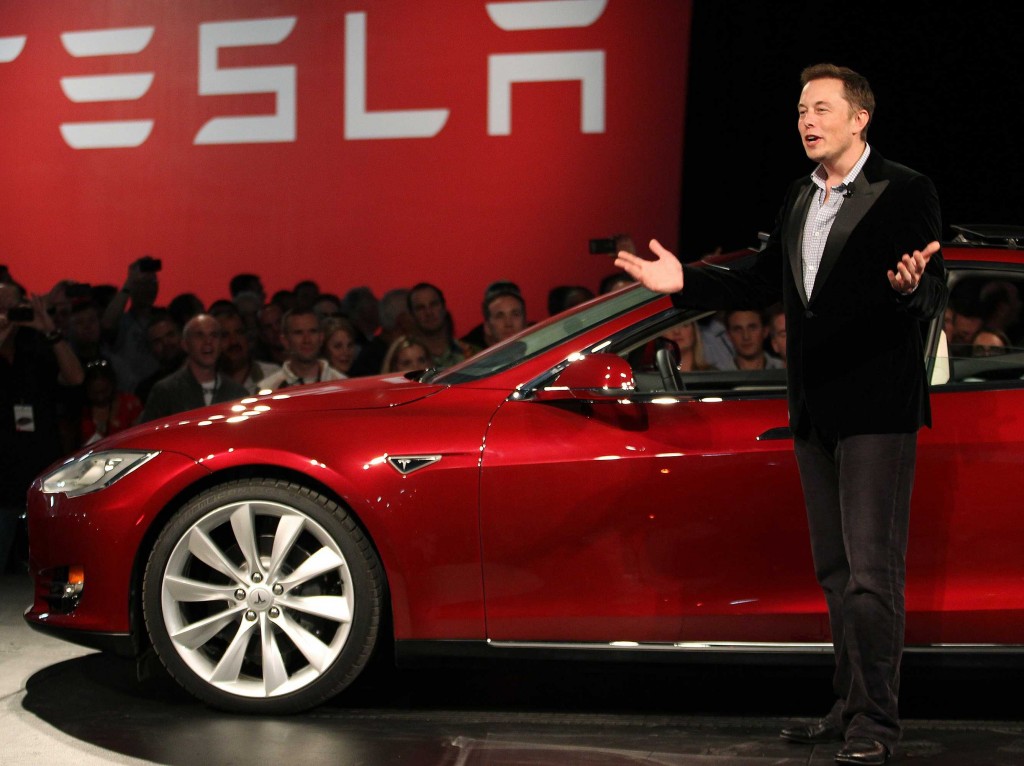

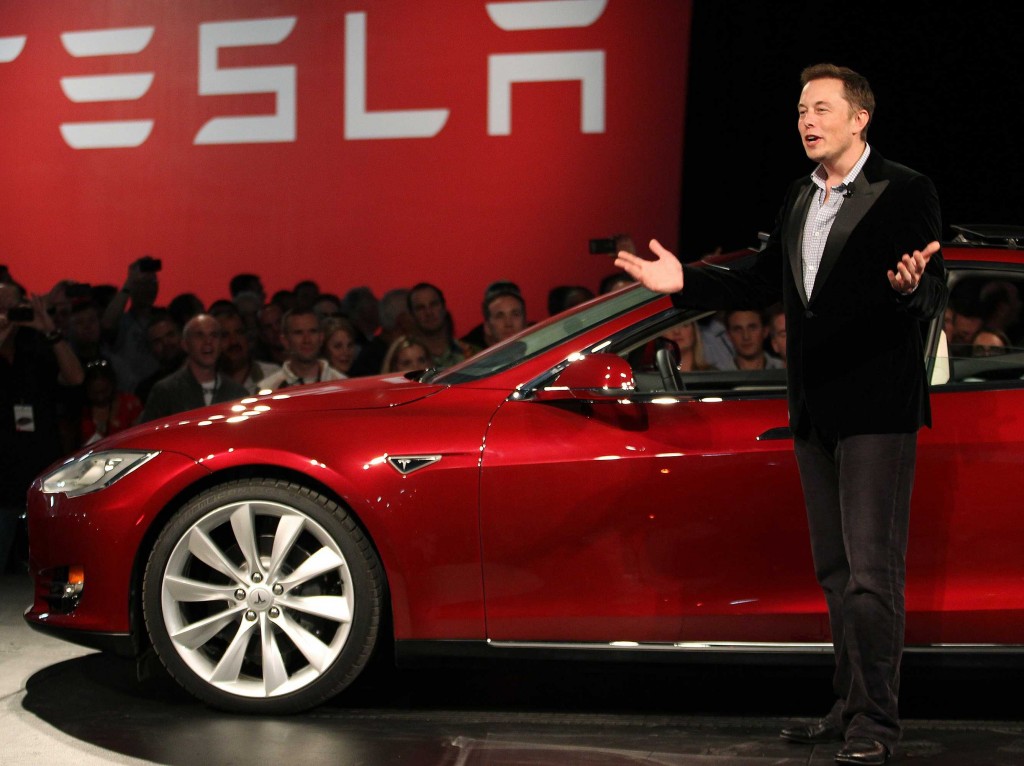

KINDRED SPIRITS OF ELON MUSK

Talking of risk taking, Chung sees himself and his boss Vinod Khosla as kindred spirits of Elon Musk, who staked all his PayPal wealth on transforming the electric car sector with Tesla Motors.

Talking of risk taking, Chung sees himself and his boss Vinod Khosla as kindred spirits of Elon Musk, who staked all his PayPal wealth on transforming the electric car sector with Tesla Motors.

“It’s a major cleantech success story,” says Chung. “Elon deserves a lot of credit…he stepped on the gas when others were giving up.”

What makes them kindred spirits? It’s more than just their strong belief in technology explains Chung. He quotes Irish playwright and cofounder of the London School of Economics, George Bernard Shaw:

“All progress depends on the unreasonable man.”

“So are you and Vinod Khosla unreasonable?” I ask.

Chung laughs. “We are contrarians!” he says. “We’re willing to do what it takes.”

He points to Khosla’s investment in Ecomotors, an internal combustion engine targetting energy efficiency gains of up to 50%. The company also has backing from Bill Gates and entered into two joint venture partnerships to build plants in China, deals involving hundreds of millions of dollars. He anticipates 200,000 engines for cars and diesel generators will roll off the production lines by the end of 2016.

“We’re addressing the transport problem from both angles,” says Chung. “We are focused on the electric revolution…battery technology investments. EcoMotors is a hedge to reflect the 99% (of the transport sector) that’s not yet electricity…electric vehicle infrastructure is still a challenge.”

SINGING FOR THE WORLD

We finally touch on what Chung calls his “secret identity,” his singing career. A finalist in Hong Kong’s version of American Idol, Chung says he has no regrets about choosing business over a singing career. Although he enjoys “bringing joy” to an audience, he’s very aware that it’s fleeting. Such momentary joy pales in comparison to his goal of having a major societal impact, or as he puts it, “Enabling 5 billion people to live like 1 billion do now.”

We finally touch on what Chung calls his “secret identity,” his singing career. A finalist in Hong Kong’s version of American Idol, Chung says he has no regrets about choosing business over a singing career. Although he enjoys “bringing joy” to an audience, he’s very aware that it’s fleeting. Such momentary joy pales in comparison to his goal of having a major societal impact, or as he puts it, “Enabling 5 billion people to live like 1 billion do now.”

Chung plans to continue singing the praises of disruptive cleantech innovation. He’s firmly committed to keeping that cleantech fire burning.

See a Fresh Dialogues interview with Andrew Chung

He learned a lot about user experience from Bit Auto, a popular web portal in China and his first business success. He’s now built a global startup – with facilities in Beijing, Shanghai, Silicon Valley, London and Munich. The global workforce is 2000.

He learned a lot about user experience from Bit Auto, a popular web portal in China and his first business success. He’s now built a global startup – with facilities in Beijing, Shanghai, Silicon Valley, London and Munich. The global workforce is 2000.

Here are more highlights from my conversation with Sebastian Thrun:

Here are more highlights from my conversation with Sebastian Thrun:

.

.